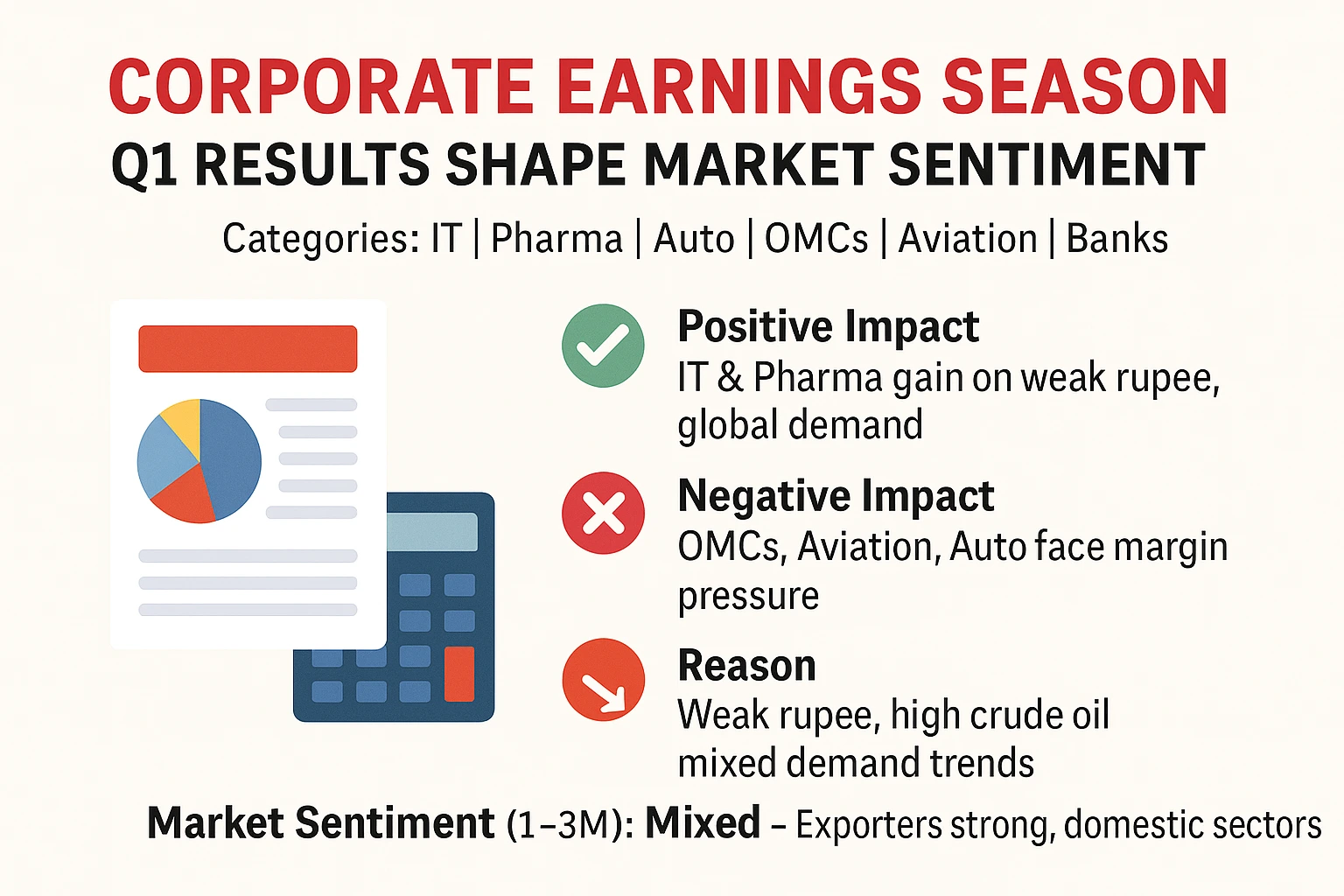

India’s Q1 earnings season is underway, giving investors a clearer picture of sectoral performance. So far, the results have been mixed, with global factors and currency movements driving outcomes.

Export-oriented sectors like Information Technology (Infosys, TCS, HCL Tech) and Pharmaceuticals (Sun Pharma, Dr. Reddy’s, Cipla) have posted healthy numbers. A weak rupee against the dollar boosted their reported earnings, while strong overseas demand added tailwinds.

On the other hand, Oil Marketing Companies (IOC, BPCL, HPCL) reported weaker margins due to high crude prices and currency depreciation. The Aviation sector also struggled with elevated fuel costs, squeezing profitability despite decent passenger demand.

The Auto sector faced challenges from rising input costs and patchy rural demand, though premium and export segments provided some cushion. Meanwhile, banks showed stable credit growth, but investors remain cautious about higher borrowing costs and margin pressure.

Overall, Q1 results highlight a market divided between exporters enjoying currency gains and domestic, import-heavy industries grappling with cost inflation.

🔹 Industries Impacted: 💻 IT | 💊 Pharma | 🚗 Auto | 🛢 OMCs | ✈️ Aviation | 🏦 Banks

✅ Positive Impact: Exporters (IT & Pharma) report stronger earnings

❌ Negative Impact: OMCs, Aviation, Auto margins under stress

📌 Reason: Weak rupee, high crude oil, and shifting demand trends

📊 Market Sentiment (1–3M): 🟡 Mixed – Sector-specific performance to guide Nifty